Dear Green Brick Partners, Inc. Stockholder:

Details of the business to be conducted at the meeting are described in the attached Notice of Annual Meeting of Stockholders and proxy statement.

Your vote is important, and we encourage you to vote whether or not you plan to attend the meeting. Please sign, date and return the enclosed proxy card in the envelope provided, or you may vote by telephone or on the Internet as described on your proxy card. If you plan to attend the meeting, you may vote in person.

Also enclosed is a copy of our Annual Report on Form 10-K for the year ended December 31, 2017.2020. I encourage you to read the Annual Report on Form 10-K for information about the Company’sour performance in 2017.

James R. Brickman

To assure your representation at the meeting, please vote by telephone, on the Internet using the instructions on the proxy card, or by signing, dating and returning the proxy card in the postage-prepaid envelope provided.

GREEN BRICK PARTNERS, INC. PROXY STATEMENT

VOTING INFORMATION

A proxy is solicited on behalf of the Board of Directors (the “Board”) of Green Brick Partners, Inc. (“Green Brick,” the “Company,” “we,” “us” or “our”) for use at the Annual Meeting to be held on May 23, 2018, beginning at 10:00 a.m., Central Time, at our executive offices located at 2805 Dallas Parkway, Suite 400, Plano, TX 75093, and at any adjournment(s) or postponement(s) thereof. We are first mailing the proxy statement and proxy card to holders of our common stock on or about April 26, 2018.

Who May Vote/Voting Rights

Stockholders of record of Green Brick’s common stock, par value $0.01 per share (“Common Stock”), at the close of business on April 11, 2018 (the “Record Date”) are entitled to receive the Notice of Annual Meeting and vote their shares at the meeting. On the Record Date, 50,685,699 shares of Common Stock were outstanding. A holder of Common Stock is entitled to one vote for each share of Common Stock held on the Record Date for each of the proposals set forth herein. There is no cumulative voting.

You are entitled to vote at the meeting if you are a stockholder of record of Common Stock on the Record Date. You may vote in person at the meeting, by automated telephone voting, on the Internet or by proxy.

To ensure that your shares are represented and voted at the Annual Meeting, we recommend that you provide voting instructions promptly byThis proxy even if you plan to attend the Annual Meeting in person, using one of the following three methods:

Submit a Proxy via the Internet. Go to the web address www.proxyvote.com and follow the instructions for submitting a proxy via the Internet shown on the proxy card sent to you. You should be aware that there may be incidental costs associated with electronic access, such as your usage charges from your Internet access providers and telephone companies, for which you will be responsible.

Submit a Proxy by Telephone. Dial 1-800-690-6903 and follow the instructions for submitting a proxy by telephone shown on the proxy card sent to you.

Submit a Proxy by Mail. If you do not wish to submit your proxy by the Internet or by telephone, please complete, sign, date and mail the enclosed proxy card in the envelope provided. If you submit a proxy via the Internet or by telephone, please do not mail your proxy card.

The Internet and telephone proxy submission procedures are designed to authenticate your identity and to allow you to submit a proxy for your shares for the matters before our stockholders as describedsummary highlights information contained elsewhere in this proxy statement and confirmdoes not contain all information that your voting instructions have been properly recorded.

Proxies submitted by telephone or viayou should review and consider. Please read the Internet for the matters before our stockholders as described in thisentire proxy statement must be receivedwith care before voting.

2021 Annual Meeting of Stockholders

| | | | | |

| Date and Time: | Wednesday, June 2, 2021, at 10:00 a.m. Central Time |

| Place: | Virtual only at www.virtualshareholdermeeting.com/GRBK2021 |

| Record Date: | April 14, 2021 |

| Voting: | Each share of Common Stock outstanding at the close of business on the record date has one vote on each matter that is properly submitted for a vote at the annual meeting. |

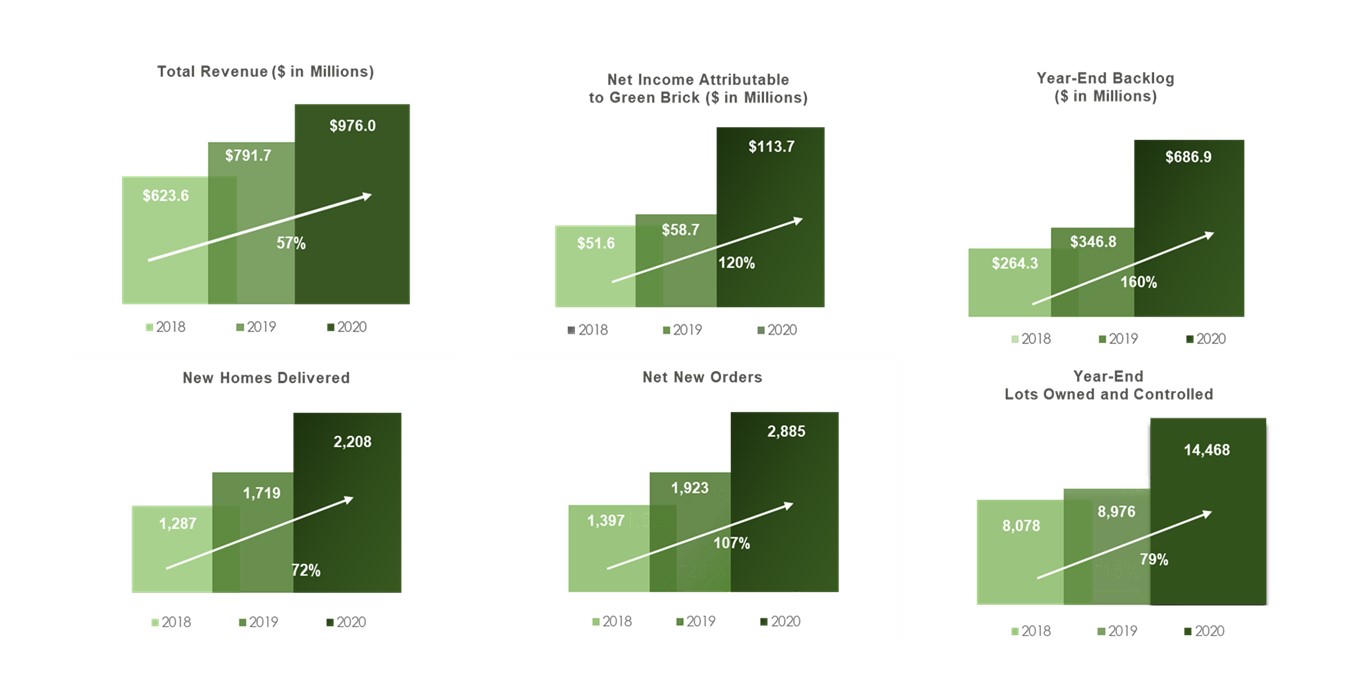

2020 Financial and Operational Highlights

Our Best Year Ever

2020 was a year full of the unexpected. A global pandemic shut down the economy for a period. The population responded by 11:59 p.m., Eastern Time, on May 22, 2018, or such later time as may be established by the Board.

How You May Revoke or Change Your VoteProxies may be revoked or changed if you:

deliverdemanding single-family housing in low-tax jurisdictions. When it was all said and done, 2020 represented a signed, written revocation letter, dated later than the proxy, tosixth-consecutive record year for Green Brick Partners, Inc., 2805 Dallas Parkway, Suite 400, Plano, TX 75093, Attention: Secretary;

and we believe positioned us for an even better 2021. We responded quickly and embraced technology to prioritize homebuyer and employee safety, including implementing remote closings, bolstering tools for digital homebuying, and offering remote work opportunities.

deliver a signed proxy, dated later than the prior proxy, to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717;2

vote again by telephone or on the Internet prior to the meeting; or

attend the meeting and give notice to the inspector of election that you intend to vote in person rather than by proxy. Your attendance at the meeting will not revoke your proxy unless you choose to vote in person.

If your shares are held in street name by a broker, bank, trust or other nominee, you must contact such organization and follow its procedures to revoke your proxy.

1

Delivering Stockholder Value

Our financial and operational performance has contributed to our ability to create significant stockholder value as we delivered 219% in Total Stockholder Return (“TSR”) for the five years ended December 31, 2020. As the chart below demonstrates, our TSR over that period surpassed the TSR of NASDAQ Composite Index (approximately 172%), S&P SmallCap 600 Index (approximately 79%) and the Russell 2000 Index (approximately 86%).

In 2020, we were proud to have our growth recognized by Fortune Magazine growth by awarding us a top 100 rank in their list of 100 fastest-growing companies in the world. We were also recognized by Forbes, which named us the 5th best small-cap (less than $2 billion market cap) public company in the country.

Proposals and Board Recommendations

| | | | | | | | | | |

| Proposal | | Board Recommendations |

| Proposal 1: | | To elect seven directors to serve until our 2022 Annual Meeting of Stockholders. | FOR each director nominee |

| Proposal 2: | | To ratify the appointment of RSM US LLP (“RSM”) as our independent registered public accounting firm for the 2021 fiscal year. | FOR |

Attending the Annual Meeting and Voting in Person

If you plan to attend the Annual Meeting and vote in person, you will be given a ballot at the Annual Meeting. Please note that admission to the Annual Meeting is limited to the Company’s stockholders as of the Record Date.

For stockholders of record, upon your arrival at the meeting location, you will need to present identification to be admitted to the Annual Meeting. If you are a stockholder who is an individual, you will need to present government-issued identification showing your name and photograph (i.e., a driver’s license or passport), or, if you are representing an institutional investor, you will need to present government-issued photo identification and professional evidence showing your representative capacity for such entity. In each case, we will verify such documentation with our Record Date stockholder list.

For stockholders holding shares in “street name,” in addition to providing identification as outlined for record holders above, you will need a valid proxy from your broker, bank or other nominee or a recent brokerage statement or letter from your broker reflecting your stock ownership as of the Record Date. Otherwise, you will not be permitted to attend the Annual Meeting. If your shares are held in the name of a broker, bank or other nominee you must obtain and bring to the Annual Meeting a proxy card issued in your name from the broker, bank or other nominee to be able to vote at the Annual Meeting.

The cost of solicitation, if any, will be borne by Green Brick. Proxies may be solicited on our behalf by directors, officers or employees, in person or by telephone, electronic transmission and facsimile transmission. No additional compensation will be paid to such persons for such solicitation. Green Brick will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to beneficial owners of shares.

Difference between a Stockholder of Record and a Beneficial Owner of Shares Held in Street NameIf your shares are registered in your name with Green Brick’s transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are the “stockholder of record” of those shares. In such case, the Notice of Annual Meeting and proxy statement and any accompanying documents have been provided directly to you by Green Brick.

If your shares are not registered in your own name and, instead, your broker, bank, trust or other nominee holds your shares, you are a “beneficial owner” of shares held in “street name.” The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. The Notice of Annual Meeting and proxy statement and any accompanying documents have been forwarded to you by your broker, bank, trust or other nominee. As the beneficial owner, you have the right to direct your broker, bank, trust or other nominee how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet.

Votes Required/Voting ProceduresThe presence at the Annual Meeting of stockholders, in person or by proxy, representing a majority of the outstanding shares entitled to vote will constitute a quorum for the transaction of business at the meeting. In general, shares of Common Stock either represented in person at the meeting or by a properly signed and returned proxy card, or properly voted by telephone or on the Internet, will be counted as present and entitled to vote at the meeting for purposes of determining the existence of a quorum. Proxies received but marked as abstentions (or “withhold authority” with respect to one or more directors) and broker non-votes will be included in the voting power considered to be present at the meeting for purposes of determining a quorum. Broker non-votes are shares held of record by a broker that are not voted on a matter because the broker has not received voting instructions from the beneficial owner of the shares and the broker either lacks or declines to exercise the authority to vote the shares in its discretion.

Proxies will be voted as specified by the stockholder. Signed proxies that lack any specification will be voted (i) “FOR” each of the Board’s director nominees and (ii) “FOR” the ratification of RSM US LLP as our independent registered public accounting firm for 2018. The proxy holders will use their best judgment with respect to any other matters properly brought before the meeting. If a nominee cannot or will not serve as a director, the proxy may be voted for another person as the proxy holders decide.

Unless you provide voting instructions to any broker holding shares on your behalf, your broker may not use discretionary authority to vote your shares on any of the matters to be considered at the Annual Meeting other than the ratification of our independent registered public accounting firm. Please vote your proxy so your vote can be counted.

Election of Directors (Proposal 1). The election of the seven director nominees to hold office until the 2019 Annual Meeting of Stockholders and the due election and qualification of their respective successors, or such director nominee’s death, removal or resignation, will be determined by a plurality vote of the shares present at the Annual Meeting, meaning the director nominee with the most affirmative votes for a particular slot is elected for that slot. Our certificate of incorporation does not permit stockholders to cumulate their votes. If you submit a properly executed proxy to the Company and the proxy indicates that you “WITHHELD” your vote for one or more of the director nominees, the shares subject to the proxy will not be voted for that director nominee or those director nominees and will be voted “FOR” the remaining director nominee(s), if any. Shares not represented at the meeting have no effect on the election of directors.

Ratification of Appointment of Independent Registered Public Accounting Firm for 2018 (Proposal 2). The affirmative vote of holders of at least a majority of the shares of Common Stock issued, present and voting at the Annual Meeting with respect to this proposal is required for the approval of this proposal. You may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on Proposal 2. Shares not represented at the meeting and proxies marked “ABSTAIN” with regard to this proposal have no effect on this proposal.

If you hold your shares in street name and do not provide voting instructions to your broker, the shares may be counted as present at the meeting for the purpose of determining a quorum and may be voted on Proposal 2 at the discretion of your broker. Such shares will not be voted at the discretion of your broker on Proposal 1 and will have no effect on the outcome of such proposal.

PROPOSAL 1: ELECTION OF DIRECTORS

Reducing Duplicate Mailings

Because stockholders may hold shares of our Common Stock in multiple accounts or share an address with other stockholders, stockholders may receive duplicate mailings of notices or proxy materials. Stockholders may avoid receiving duplicate mailings as follows:

Stockholders of Record. If your shares are registered in your own name and you are interested in consenting to the delivery of a single notice or single set of proxy materials, you may contact Broadridge Householding Department by phone at 1-800-542-1061 or by mail to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

Beneficial Stockholders. If your shares are not registered in your own name, your broker, bank, trust or other nominee that holds your shares may have asked you to consent to the delivery of a single notice or single set of proxy materials if there are other Green Brick stockholders who share an address with you. If you currently receive more than one copy of the notice or proxy materials at your household and would like to receive only one copy in the future, you should contact your nominee.

Right to Request Separate Copies. If you consent to the delivery of a single notice or single set of proxy materials but later decide that you would prefer to receive a separate copy of the notice or proxy materials, as applicable, for each stockholder sharing your address, then please notify Broadridge Householding Department or your nominee, as applicable, and they will promptly deliver the additional notices or proxy materials. If you wish to receive a separate copy of the notice or proxy materials for each stockholder sharing your address in the future, you may also contact Broadridge Householding Department by phone at 1-800-542-1061 or by mail to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

We are a diversified homebuilding and land development company. We acquire and develop land, provide land and construction financing to our controlled builders and participate in the profits of our controlled builders. Our core markets are in the high growth U.S. metropolitan areas of Dallas, Texas and Atlanta, Georgia. We also own a noncontrolling interest in Challenger Homes in Colorado Springs, Colorado. We are engaged in all aspects of the homebuilding process, including land acquisition and the development, entitlements, design, construction, marketing and sales and the creation of brand images at our residential neighborhoods and master planned communities. We believe we offer higher quality homes with more distinctive designs and floor plans than those built by our competitors at comparable prices. Our communities are located in premium locations in our core markets and we seek to enhance homebuyer satisfaction by utilizing high-quality materials, offering a broad range of customization options and building well-crafted energy-efficient homes. We seek to maximize value over the long term and operate our business to mitigate risks in the event of a downturn by controlling costs and quickly reacting to regional and local market trends.

Green Brick Partners, Inc. (formerly named BioFuel Energy Corp.) was incorporated as a Delaware corporation on April 11, 2006, to invest solely in BioFuel Energy, LLC, a limited liability company organized on January 25, 2006, to build and operate ethanol production facilities in the Midwestern United States. On November 22, 2013, the Company disposed of its ethanol plants and all related assets. Following the disposition of these production facilities, we were a public shell company with no substantial operations.

On June 10, 2014, the Company entered into a definitive transaction agreement with the owners of JBGL (as defined below) to acquire JBGL Builder Finance LLC and its consolidated subsidiaries and affiliated companies (collectively “Builder Finance”), and JBGL Capital Companies (“Capital”), a combined group of commonly managed limited liability companies and partnerships (collectively with Builder Finance, “JBGL”) for $275.0 million, payable in cash and shares of our Common Stock (the “Transaction”). JBGL is a real estate operator involved in the purchase and development of land for residential use, construction lending and homebuilding operations. The Transaction was completed on October 27, 2014. Pursuant to the terms of the Transaction, we paid the $275.0 million purchase price with approximately $191.8 million in cash and the remainder in 11,108,500 shares of our Common Stock valued at approximately $7.49 per share.

The cash portion of the purchase price was primarily funded from the proceeds of a $70.0 million rights offering conducted by the Company (the $70.0 million includes proceeds from purchases of shares of common stock by certain funds and accounts managed by Greenlight Capital, Inc. and its affiliates (“Greenlight”) and Third Point LLC and its affiliates (“Third Point”)) and $150.0 million of debt financing provided by Greenlight pursuant to a loan agreement, with the lenders from time to time party thereto, which provided for a five year term loan facility (the “Term Loan Facility”). In 2015, the Term Loan Facility was repaid in full.

As described above, at the time the Transaction was completed, BioFuel Energy Corp. was a non-operating public shell corporation with nominal assets and as a result of the Transaction the owners and management of JBGL gained effective operating control of the combined company.

As a result of the Transaction, Green Brick changed its business direction and is now a diversified homebuilding and land development company.

BOARD OF DIRECTORS AND GOVERNANCEBoard Structure and CompositionThe Company’s Amended and Restated Certificate of Incorporation (the “Charter”) provides that the number of directors will be fixed in the manner provided in the Amended and Restated Bylaws of the Company, dated as of March 20, 2009 (the “Bylaws”). The Bylaws provide that the number of directors will be fixed from time to time pursuant to a resolution adopted by the Board. Theour Board of Directors (the “Board”). Our Board currently has seven members. Directors are elected by plurality vote of the shares present at the Annual Meeting, meaning that the director nominee with the most affirmative votes for a particular slot is elected for that slot.voting thereon. If a vacancy occurs, including as a result of an increase in the authorized number of directors, the vacant directorship may be filled only by the affirmative vote of a majority of the remaining directors. Each director holds office until the next annual stockholder meeting or until the due election and qualification of his or her successor, or until such director’s death, removal or resignation.

The Governance and Nominating Committee works with our Board on an annual basis to determine the appropriate skills, qualifications and experience for each director and for our Board as a whole. In making its recommendation to the Board for a slate of directors for election by our stockholders, the Governance and Nominating Committee considers the criteria described in “Governance and Nominating Committee — Stockholder Nominations of Director Candidates” in this proxy statement.

The

Director Nominees

Our Board, upon the recommendation of Directors is currently comprisedthe Governance and Nominating Committee, has nominated each of seven members, including: four independentour current directors, David Einhorn, James R. Brickman, Chief Executive Officer (“CEO”) of the Company, David Einhorn, President of Greenlight Capital, Inc., and Harry Brandler, Chief Financial Officer of Greenlight Capital, Inc. Elizabeth K. Blake, Harry Brandler, John R. Farris, Kathleen Olsen and Richard S. Press, currentlyto be elected to serve as independent directors on the Board. An “independent director” means a director or director nominee who satisfies all standards for independence under the rules and regulationsmember of the Securities and Exchange Commission (“SEC”),Board for a one-year term expiring at the 2022 Annual Meeting of Stockholders and the NASDAQ Stock Market (“NASDAQ”) listing rules. David Einhorn servesdue election and qualification of their respective successors, or such nominee’s death, removal or resignation.

Our current Board is comprised of:

| | | | | | | | |

| James R. Brickman | Elizabeth K. Blake | Kathleen Olsen |

| David Einhorn | John R. Farris | Richard S. Press |

| Harry Brandler | | |

The biographies of each of the director nominees below contain information regarding age, the year they first became directors, business experience, other public company directorships held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experience, qualifications, attributes or skills that caused the Governance and Nominating Committee to determine that they should serve as our Chairmandirectors.

DIRECTOR NOMINEES

| | | | | | | | | | | | | | |

David Einhorn Director since: 2006 Co-Founder Age: 52 |

Background:

Since 1996, Mr. Einhorn has been the President of Greenlight Capital, Inc., which along with its affiliates is investment advisor to our principal stockholders. Mr. Einhorn serves as Chairman of Greenlight Capital Re, Ltd. (NASDAQ: GLRE). Mr. Einhorn received a Bachelor of Arts degree in Government from Cornell University. | |

Skills & Qualifications The Board has nominated Mr. Einhorn because he provides the Board with crucial investment expertise and business experience.  Executive Leadership Executive Leadership  Industry Experience Industry Experience  Investment and Capital Management Investment and Capital Management |

James R. Brickman Director since: 2014 Chief Executive Officer and Co-Founder Age: 69

|

Background:

Mr. Brickman has served as our Chief Executive Officer since 2014. Previously, Mr. Brickman was the founding manager and advisor of each of JBGL Capital LP since 2008 and JBGL Builder Finance LLC since 2010 (collectively “JBGL”), and became our Chief Executive Officer following our acquisition of JBGL in 2014. Prior to forming JBGL, Mr. Brickman was a manager of various joint ventures and limited partnerships that developed/built low and highrise office buildings, multifamily and condominium homes, single family homes, entitled land and supervised a property management company. He previously also served as Chairman and Chief Executive Officer of Princeton Homes Ltd. and Princeton Realty Corporation that developed land, constructed single family custom homes and managed apartments it built. Mr. Brickman has over 40 years’ experience in nearly all phases of real estate construction, development and real estate finance property management. He received a B.B.A. and M.B.A. from Southern Methodist University. | |

Skills & Qualifications The Board has nominated Mr. Brickman because of his substantial experience in residential land development, the homebuilding industry and management, as well as intimate knowledge of the our business and operations.  Executive Leadership Executive Leadership  Industry Experience Industry Experience  Human Resources and Talent Management Human Resources and Talent Management |

| | | | | | | | | | | | | | |

Elizabeth K. Blake Director since: 2007 Independent Age:69

Committees: • Compensation • Governance and Nominating X(Chair)

|

Background:

Before retiring, Ms. Blake served as Senior Vice President — Advocacy, Government Affairs & General Counsel of Habitat For Humanity International Inc. from 2006 to 2014. Ms. Blake served on the Board of Patina Oil & Gas Corporation from 1998 through its sale to Noble Energy in 2005. From March 2003 to 2005, Ms. Blake was the Executive Vice President — Corporate Affairs, General Counsel and Corporate Secretary for US Airways Group, Inc. From April 2002 through December 2002, Ms. Blake served as Senior Vice President and General Counsel of Trizec Properties, Inc., a public real estate investment trust. Ms. Blake served as Vice President and General Counsel of General Electric Power Systems from 1998 to 2002. From 1996 to 1998, Ms. Blake served as Vice President and Chief of Staff of Cinergy Corp. Ms. Blake was with the law firm of Frost & Jacobs from 1982 and a partner from 1984 to 1996. From 1977 to 1982, she was with the law firm of Davis Polk & Wardwell in New York. She is past Chair of the Ohio Board of Regents. Ms. Blake received a Bachelor of Arts degree with honors from Smith College and her Juris Doctor from Columbia Law School, where she was a Harlan Fiske Stone Scholar. | |

Skills & Qualifications The Board has nominated Ms. Blake because she provides the Board with extensive executive, corporate governance and risk management experience and leadership experience as an executive of the nation’s largest non-profit homebuilding corporation and as an officer and director with multiple public companies.  Corporate Governance Corporate Governance  Legal Experience Legal Experience  Risk Management Risk Management |

Harry Brandler Director since: 2014 Independent Age: 49

|

Background: Before retiring in January 2019, Mr. Brandler served as the Chief Financial Officer of Greenlight Capital, Inc. from December 2001 to January 2019. Prior to joining Greenlight Capital, Inc., from 2000 to 2001, Mr. Brandler served as Chief Financial Officer of Wheatley Partners, a venture capital firm, where he oversaw the firm’s back office operations and restructured the firm’s marketing, client relations and technology. From 1996 to 2000, Mr. Brandler served as a Manager at Goldstein, Golub & Kessler, where he provided audit, tax and consulting services to investment partnerships and other financial organizations and where he was promoted to Manager in January 1999. Mr. Brandler received a B.S. in Accounting from New York University in 1993. Mr. Brandler was admitted as a Certified Public Accountant in New York in 1996. | |

Skills & Qualifications The Board has nominated Mr. Brandler because of his substantial knowledge and experience in the areas of finance, accounting and management.  Executive Leadership Executive Leadership  Finance and Accounting Finance and Accounting  Investment and Capital Management Investment and Capital Management |

| | | | | | | | | | | | | | |

John R. Farris Director since: 2014 Independent Age: 48

Committees: • Audit • Governance and Nominating

|

Background:

Since 2007, Mr. Farris has been the President of LandFund Partners, LLC and President of Commonwealth Economics, LLC. From 2008 to 2012, Mr. Farris served as an adjunct Professor of Economics and Finance at Centre College in Danville, Kentucky. Prior to forming LandFund Partners and Commonwealth Economics, LLC, from 2006 to 2007, Mr. Farris served as Secretary of the Finance and Administration Cabinet for the Commonwealth of Kentucky. He previously served on the board of directors for Farmers Capital Bank Corporation from 2010 to 2016. Mr. Farris received a B.S. from Centre College in 1995 and a M.P.A. from Princeton University in 1999. | |

Skills & Qualifications The Board has nominated Mr. Farris because he brings to the Board a wealth of knowledge and experience in economics and finance and his experience with other boards.  Executive Leadership Executive Leadership  Corporate Governance Corporate Governance  Investment and Capital Management Investment and Capital Management

|

Kathleen Olsen Director since: 2014 Independent Age: 49

Committees: • Audit (Chair) • Compensation • Governance and Nominating |

Background:

Since 2011, Ms. Olsen has been a private investor. From 1999 through 2011, Ms. Olsen served as Chief Financial Officer of Eminence Capital, LLC, a long/short global equity fund. From 1993 to 1999, Ms. Olsen served as audit manager, specializing in investment partnerships, at Anchin, Block & Anchin LLP, a public accounting firm located in New York City. Ms. Olsen received a Bachelor of Science degree with honors from the State University of New York at Albany. Ms. Olsen is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and New York State Society of Certified Public Accountants. | |

Skills & Qualifications The Board has nominated Ms. Olsen because she has extensive knowledge of accounting and a background in finance which enables her to make valuable and important contributions to the Board.  Finance and Accounting Finance and Accounting  Investment and Capital Management Investment and Capital Management  Executive Leadership Executive Leadership

|

| | | | | | | | | | | | | | |

Richard S. Press Director since: 2014 Independent Age: 82

Committees: • Audit • Compensation (Chair) |

Background:

Before retiring, Mr. Press was a Senior Vice President at Wellington Management from 1994 to 2006, where he started and built the firm’s insurance asset management practice. Prior to that, Mr. Press was a Senior Vice President of Stein Roe & Farnham from 1982 to 1994. Mr. Press has been a board member of Millwall Holdings PLC and Millwall Football Club, London since 2010; and is an emeritus member of the Board of Overseers Leadership Board of Beth Israel Deaconess Medical Center (Boston) having served since 2007. Previously he served on various committees of the Controlled Risk Insurance Company and the Harvard Risk Management Foundation from 2006 to 2017; served as a board member of the Housing Authority Insurance Group from 2008 to December 2014; and served as a board member and chairman of each of Transatlantic Holdings (NYSE: TRH) from August 2006 to March 2012 and Pomeroy IT Solutions (NASDAQ: PMRY) from July 2007 to November 2009. He was a founding member of the Board of Governors and the Advisory Board of the National Pediatric Multiple Sclerosis Center, Stony Brook University and Medical School, New York (2001 – 2013). Mr Press earned a B.A. in Economics from Brown University in 1960; and after serving in the US Army, he received his M.B.A. from Harvard Business School in 1964. | |

Skills & Qualifications The Board has nominated Mr. Press because of his extensive background in finance and his public company board and committee experience.  Corporate Governance Corporate Governance  Risk Management Risk Management  Human Resources and Talent Management Human Resources and Talent Management

|

Board Voting Recommendation

The Board recommends that stockholders vote “FOR” the election of each director nominee.

CORPORATE GOVERNANCE

Director Independence

Under the NASDAQ listing standards,Nasdaq Listing Standards, independent directors are required to constitute a majority of theour Board. Our Board makes a formal determination each year as to which of our directors and director nominees are independent. The Board has determined that the following directors or director nominees are independent within the meaning of the NASDAQ listing standards and the applicable SEC rules and regulations:Nasdaq Listing Standards: Harry Brandler, Elizabeth K. Blake, John R. Farris, Kathleen Olsen and Richard S. Press.

In making its determination regarding the independence of Mr. Brandler, Ms. Olsen and Mr. Press, the Board considered that each of these individuals has invested in limited partnership interests in funds managed by Greenlight Capital, Inc. or its affiliates. We refer to these funds as the “Greenlight Funds”. However, because none of these directors has received any compensation from the Greenlight Funds, the Board has determined that such interests would not interfere with the exercise of independent judgment in carrying out the responsibilities of such directors.

Board Meetings/Attendance at Annual Meeting

The Board held five (5)six meetings in fiscal year 2017.2020. Each director attended at least 75 percent of the aggregate number of meetings of the Board and meetings of the committees on which the director served.

Attendance at Annual Meetings of StockholdersUnder our Corporate Governance Guidelines, directors are expected to attend Board meetings and meetings of committees on which they serve. Director attendance is not required at Annual Meetingsannual meetings of Stockholders. Three (3)stockholders. Two members of the Board attended the 20172020 Annual Meeting of Stockholders.

Board Leadership Structure

The positions of Chairman and CEO are held by two different individuals. David Einhorn serves as the Company’sour Chairman and James R. Brickman serves as the Company’sour CEO. Separating these positions allows our CEO to focus on our day-to-day business and operations, while allowing our Chairman to lead the Board in its fundamental role of providing advice to and oversight of management. The Chairman provides leadership to our Board and works with the Board to define its structure and activities in the fulfillment of its responsibilities. The Chairman sets the board agendas, in consultation with our CEO and the other officers and directors, facilitates communications among and information flow to directors, has the power to call special meetings of our Board and stockholders and presides at meetings of our Board and stockholders. The Chairman also advises and counsels our CEO and other officers. Pursuant to our Corporate Governance Guidelines, the non-employee directors and independent directors meet in executive session, without management present, at each of the regularly scheduled meetings of the Board, and at such other times as may be determined by a majority of the independent directors. In addition, at least once a year, only independent, non-employee directors shall meet in executive session. The CompanyBoard does not currently have a lead independent director.

Board’s Role in Risk Oversight The Governance and Nominating Committee is responsible for assisting the Board and its other committees that oversee specific risk-related issues and serves as a resource to management by overseeing the Company’sour enterprise risk management function,functions, including those related to information technology security.

The Governance and Nominating Committee meets periodically with key members of management to review the Company’sour business and agree upon itsour strategy and the risks involved with such strategy. Management and the Governance and Nominating Committee discuss the amount of risk the Company iswe are willing to accept related to implementing our strategy. On a periodic basis management meets directly with the Governance and Nominating Committee to provide an update on key risks and theirthe processes and systems to manage the such

risks. The Governance and Nominating Committee reviews and approves management’s enterprise risk policies, procedures and practices and periodically reviews and reports to the Board (a) the magnitude of all material business risks, (b) the enterprise risk policies, procedures and practices in place to manage material risks and (c) the overall effectiveness of the risk management process.

The Board approves actions surrounding our capital structure, debt agreements, and legal settlements to the extent applicable, and approves the annual budget. Key finance and accounting management meet directly with the Board to provide an update on our financial results. The Board regularly assesses management’s response to critical risks and recommends changes to management, including changes in leadership, where appropriate.

The Board delegates responsibility for overseeing certain financial risks to the Audit Committee. The Audit Committee monitors the quality and integrity of our financial statements and our compliance with legal and regulatory requirements. The Audit Committee is also responsible for understanding the Company’sour financial risk assessment and risk management policies. The Audit Committee also reviews and approves the annual audit plan and regularly reports to the Board. For additional information with respect to

The Board has three standing committees: the Audit Committee, see “Part Two — Boardthe Compensation Committee and the Governance and Nominating Committee. Copies of Directors and Governance — Board Committees — Audit Committee” in this proxy statement.

Thethe committee charters of each of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee have been established bysetting forth the Board in order to comply with the applicable rules and regulationsrespective responsibilities of the SECcommittees can be found under the “Investors & Governance – Board of Directors - Governance” section of our website at www.greenbrickpartners.com, and such information is also available in print to any stockholder who requests it through our Investor Relations department. Each of the NASDAQ Listing Rules. committees reviews, and revises if necessary, its respective charter not less than annually.

The table below sets forth the directors appointed to each of the committees are as follows:committees:

| | | | | | | | | | | |

| Independent Director | Audit Committee | Compensation Committee | Governance and Nominating Committee |

| Elizabeth K. Blake | | Member | Chair |

| John R. Farris | Member | | Member |

| Kathleen Olsen | Chair | Member | Member |

| Richard S. Press | Member | Chair | |

Audit Committee

John R. FarrisNumber of Meetings: 4

Richard S. Press

Compensation Committee

Richard S. Press*

Elizabeth K. Blake

Kathleen Olsen

Governance and Nominating Committee

Elizabeth K. Blake*

John R. Farris

Kathleen Olsen

* Committee Chair

Audit Committee

Each member of ourResponsibilities. The Audit Committee has been determinedoperates under a written charter adopted by the Board, to be an independent director according towhich is evaluated annually. In accordance with its charter, the rules and regulations of the SEC and the NASDAQ listing rules, and Ms. Olsen has been determined by the Board to be an “audit committee financial expert” as such term is defined in the rules and regulations of the SEC. The Audit Committee has responsibility for, among other things:

•retaining, compensating, overseeing and terminating any registered public accounting firm in connection with the preparation or issuance of an audit report, and approving all audit services and any permissible non-audit services provided by the independent registered public accounting firm;

•receiving direct reports from any registered public accounting firm engaged to prepare or issue an audit report;

•reviewing and discussing annual audited and quarterly unaudited financial statements with management and the independent registered public accounting firm;

•reviewing with the independent registered public accounting firm any audit problemsissues and management’s response;

•discussing earnings releases, financial information and earnings guidance provided to analysts and rating agencies;

•periodically meeting separately with management, internal auditors and the independent registered public accounting firm;

•establishing procedures to receive, retain and treat complaints regarding accounting, internal accounting controls or auditing matters and the confidential anonymous submission by employees of concerns regarding questionable accounting or auditing matters;

•obtaining and reviewing, at least annually, an independent registered public accounting firm report describing the independent registered public accounting firm internal quality-control procedures and any material issues raised by the most recent internal quality-control review of the independent registered public accounting firm or any inquiry by governmental authorities;

•approving and recommending to the Board the hiring of any employees or former employees of the independent registered public accounting firm;

•retaining independent counsel and other outside advisors, including experts in the area of accounting, as it determines necessary to carry out its duties; and

•reporting regularly to the full Board with respect to any issues raised by the foregoing.

The Audit Committee held seven (7) meetings in fiscal year 2017.Independence and Financial Expertise. The Board has adopted a written charter forreviewed the Audit Committee, which is available in the Governance section of our website at www.greenbrickpartners.com.

For additional information regarding the responsibilitiesbackground, experience and independence of the Audit Committee see “Part Two —members based primarily on the directors’ responses to questions relating to their relationships, background and experience. The Board has determined that each member of Directorsthe Audit Committee is independent under the Nasdaq Listing Standards and Governance — Board’s Rolemeets the enhanced independence standards for audit committee members required by the Nasdaq Listing Standards and the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”). In addition, the Board has determined that all members of the Audit Committee are financially literate under the Nasdaq Listing Standards and Ms. Olsen has been determined to be an “audit committee financial expert” as such term is defined in Risk Oversight” in this proxy statement.the rules and regulations of the SEC.

Number of Meetings: 4

Responsibilities. The Compensation Committee

The operates under a written charter adopted by the Board. In accordance with its charter, the Compensation Committee has responsibility for, among other things:

•reviewing key employee compensation policies, plans and programs;

•reviewing and approving the compensation of the Chief Executive Officerour CEO and other executive officers of the Company and its subsidiaries;

officers;•reviewing and approving any employment contracts or similar arrangements between the Companyus and any of our executive officerofficers;

•reviewing and consulting with theour Chairman and Chief Executive Officer of the CompanyCEO concerning performance of individual executives and related matters;

•reviewing and

making recommendations to the Board regarding director compensation; and•administering the Company’sour stock plans, incentive compensation plans and other similar plans that the Board may from time to time adopt and exercising all the powers, duties and responsibilities of the Board with respect to the plans.

Independence. The Board reviewed the background, experience and independence of the Compensation Committee held nine (9) meetings in fiscal year 2017. members based primarily on the directors’ responses to questions relating to their relationships, background and experience. Based on this review, the Board determined that each member of the Compensation Committee meets the independence requirements of the Nasdaq Listing Standards, including the heightened independence requirements specific to Compensation Committee members.

| | |

| Governance and Nominating Committee |

Number of Meetings: 4

Responsibilities. The Board has adoptedGovernance and Nominating Committee operates under a written charter foradopted by the Compensation Committee, which is available inBoard. In accordance with its charter, the Governance section of our website at www.greenbrickpartners.com.

Governance and Nominating Committee

The Governance and Nominating Committee has responsibility for, among other things:

•recommending to the Board proposed nominees for election to the Board by the stockholders at annual meetings, including an annual review as to the re-nominations of incumbents and proposed nominees for election by the Board to fill vacancies that occur between stockholder meetings;

•reviewing and approving or ratifying related party transactions under the Company’sour Related Party Policy;

•making recommendations to the Board regarding corporate governance matters and practices; and

•assisting the Board and its other committees that oversee specific risk-related issues and serving as a resource to management by overseeing the Company’sour enterprise risk management function,functions, including risks related to information technology security.

Consideration of Director Nominees. The Governance and Nominating Committee considers possible candidates for nominees for directors from many sources, including management and stockholders. The Governance and Nominating Committee evaluates the suitability of potential candidates nominated by stockholders in the same manner as other candidates recommended to the Governance and Nominating Committee. Although there are no minimum qualifications for nominees, the charter of the Governance and Nominating Committee requires that the Governance and Nominating Committee select nominees to become directors based on an assessment of the fulfillment of necessary independence requirements for the composition of the Board; the highest ethical standards and integrity; a willingness to act on and be accountable for Board decisions; an ability to provide wise, informed and thoughtful counsel to top management on a range of issues; and individual backgrounds that provide a diverse portfolio of experience and knowledge commensurate with the Board’s needs. Although no formal policy currently exists, the Governance and Nominating Committee seeks to promote through the nomination process an appropriate diversity of experience, expertise, education, perspective, age, gender and ethnicity, and includes such diversity considerations when appropriate in connection with potential nominees.

The Governance and Nominating Committee held four (4) meetingsidentifies nominees by first evaluating the current members of the Board willing to continue in fiscal year 2017. Theservice. Current members of the Board has adoptedwith skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a written charter fornew perspective. If any member of the Board does not wish to continue in service or if the Governance and Nominating Committee which is available inor the Governance section of our website at www.greenbrickpartners.com.

Compensation Committee Interlocks and Insider ParticipationThe Compensation Committee members are Richard S. Press (chair), John R. Farris and Kathleen Olsen. None of our executive officers serve asBoard decides not to re-nominate a member of our Compensation Committee. None of our executive officers serves on the board of directors or compensation committee of a company that has an executive officer that serves on our Board or the Compensation Committee.

Communications with the BoardStockholders or other interested parties may communicate with one or more members of the Board by writing to the Board or a specific director at:

Board of Directors (or specific director)

Green Brick Partners, Inc.

2805 Dallas Parkway, Suite 400

Plano, TX 75093

Communications addressed to individual Board members will be forwarded by the Secretary to the individual addressee. Any communications addressed to the Board will be forwarded by the Secretary to the Chairman of the Board.

Stockholder Recommendations for Director Candidates and Director QualificationsDirectors are nominated byre-election, the Governance and Nominating Committee identifies the desired skills and experience of the Board, or by the entire Board acting as such.a new nominee.

Stockholder Nominations of Director Candidates. Stockholders can suggest qualified candidates for director by giving written notice to our Secretary at Green Brick Partners, Inc., 2805 Dallas Parkway, Suite 400, Plano, TX 75093. The notice should include the name and qualifications of the candidate and any supporting material the stockholder feels is appropriate. In considering any candidate proposed by a stockholder, the Governance and Nominating Committee will reach a conclusion based on the Board’s established criteria. The Governance and Nominating Committee may seek additional information regarding the candidate. After full consideration, the stockholder proponent will be notified of the decision of the Governance and Nominating Committee.

Although there are no minimum qualifications for nominees, the charter of the Governance and Nominating Committee requires that the Governance and Nominating Committee select nominees to become directors based on an assessment of the fulfillment of necessary independence requirements for the composition of the Board; the highest ethical standards and integrity; a willingness to act on and be accountable for Board decisions; an ability to provide wise, informed and thoughtful counsel to top management on a range of issues; and individual backgrounds that provide a diverse portfolio of experience and knowledge commensurate with the Company’s needs. Although no formal policy exists, the Governance and Nominating Committee seeks to promote through the nomination process an appropriate diversity of experience, expertise, perspective, age, gender and ethnicity, and includes such diversity considerations when appropriate in connection with potential nominees.

A stockholder who wishes to nominate a person for the election of directors must ensure that the nomination complies with our Bylaw provisions on making stockholder nominations at an Annual Meetingannual meeting of Stockholders.stockholders. For information regarding stockholder proposals for our 20192022 Annual Meeting of Stockholders, see the section entitled “Part Four — Other Important Information“Other Matters — Stockholder Proposals for the 20192022 Annual Meeting” in this proxy statement.

Other Corporate Governance Matters

Corporate Governance Guidelines. Our The Board has voluntarily adopted Corporate Governance Guidelines. Our Corporate Governance Guidelines describe our corporate governance guidelines, in accordance with applicable rulespractices and regulations of the SECpolicies and the NASDAQ listing rules, to govern the responsibilities and requirements of the Board. Theprovide a framework for our Board governance. Corporate Governance Guidelines are available in the Investors & Governance section of our website at www.greenbrickpartners.com.

Code of Business Conduct and Ethics. The Company has We have adopted a Code of Business Conduct and Ethics that applies to our directors, officers and to all of our employees, including the Chief Executive Officer and the Chief Financial Officer.employees. This Code of Business Conduct and Ethics is posted on our website at www.greenbrickpartners.com. Any waivers of, or amendments to, our Code of Business Conduct and Ethics will be posted on our website and reported as required by the SEC.

PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING

PROPOSAL 1: ELECTION OF DIRECTORSDirector Nominees — Qualifications and BackgroundRelated Person Transaction Approval Policy

The following individuals are nominated asBoard has adopted a written policy for the review, approval and ratification of transactions with related persons. The policy covers related party transactions between us and any of our senior managers and directors for terms expiring at the 2019 Annual Meetingor their respective affiliates, director nominees, 5% or greater security holders or family members of Stockholders: David Einhorn, James R. Brickman, Elizabeth K. Blake, Harry Brandler, John R. Farris, Kathleen Olsen and Richard S. Press. Each of these individuals is currently serving as a directorany of the Company. Each of the nominees has consented to being named inforegoing. Related party transactions covered by this proxy statement and to serve as a director if elected. Each nominee elected as a director will continue in office until the next Annual Meeting of Stockholders and the due election and qualification of their respective successors, or such nominee’s death, removal or resignation. If any nominee is unable to serve, proxies will be voted in favor of the remaining nominees and may be voted for another person nominatedpolicy are reviewed by the Board. In making its recommendation to the Board for a slate of directors for election by the Company’s stockholders, the Governance and Nominating Committee considered the criteria described in “Part Two — Board of Directors and Governance — Stockholder Recommendations for Director Candidates and Director Qualifications” in this proxy statement. The biographies of each of the director nominees below contain information regarding age, the year they first became directors, business experience, other public company directorships held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experience, qualifications, attributes or skills that caused theour Governance and Nominating Committee to determine that they should serve as directors ofwhether the Company.

David Einhorn — Mr. Einhorn, age 49, has been onetransaction is in our best interests and the best interests of our directors since May 2006. From 1996, Mr. Einhorn has beenstockholders. As a result, approval of related party business will be denied if, among other factors, it is determined that the Presidentproposed transaction is not fair and reasonable and on terms no less favorable to us than could be obtained in a comparable arms-length transaction with an unrelated third party.

Transactions with Related Persons

During 2020, we held a ninety-percent membership interest and a ninety percent voting interest in CLH20, LLC (“CLH20”), the owner of Centre Living Homes, LLC (“Centre Living”), a builder that focuses on luxury townhomes in the Dallas, Texas market. The remaining ten percent of membership interests and

voting interests in CLH20 is held by Trevor Brickman, son of our CEO James R. Brickman. During the year ended December 31, 2020, Trevor Brickman made cash contributions to Centre Living of $400,000.

In November 2020, Greenlight Capital, Inc, on behalf of itself and certain affiliates (collectively, “Greenlight”), exercised its registration rights pursuant to the Registration Rights Agreement, dated October 27, 2014, by and between us, certain affiliates of Greenlight Capital, Inc., which along with its affiliates is investment advisor to our principal stockholders. Mr. Einhorn serves as Chairman of Greenlight Capital Re, Ltd. (NASDAQ: GLRE). Mr. Einhorn received a Bachelor of Arts degree in Government from Cornell University.

The Board has nominated Mr. Einhorn because he provides the Board with crucial investment expertise and business experience.

Inc, James R. Brickman — Mr. and certain family members of and trusts affiliated with James R. Brickman age 66, has(the “Registration Rights Agreement”). The Registration Rights Agreement had been one ofentered into in connection with our directors since October 2014, was the founding manager and advisor of eachacquisition of JBGL Capital LP since 2008Companies and JBGL Builder Finance LLC and its consolidated subsidiaries. In connection with such rights, we filed a registration statement on Form S-3 and paid registration fees to the SEC on behalf of Greenlight of approximately $60,000.

DIRECTOR COMPENSATION

Annual Retainer

2020 Compensation – Our 2020 independent director compensation program consisted of an annual cash retainer of $80,000 paid quarterly in arrears and an equity grant of $90,000 in shares of restricted Common Stock. Our Chairman’s compensation package consisted of an annual cash retainer equal to $50,000 in 2020 but did not include an equity grant. Each director has the option to elect to receive all or a portion of his or her cash retainer in the form of shares of restricted Common Stock. Restricted stock awards, including equity received in lieu of cash, vest on the earlier of the anniversary of the grant date or the date of our next annual meeting of stockholders, provided that the director is then serving on the Board.

During the second quarter of 2020, in light of the uncertainty resulting from the onset of the COVID-19 pandemic at the time, each of our directors voluntarily agreed to reduce their cash retainers by 30% for the remainder of the year.

2021 Compensation – The compensation of our independent directors was last amended in March 2019. Effective January 1, 2021, the Board approved an increase in the cash portion of non-employee independent directors’ annual retainer to $100,000, to be paid quarterly in arrears, and an increase in the annual equity grant to $110,000 in shares of restricted Common Stock, effective upon reelection to the Board with the same vesting schedule. The Board also approved the first increase in the compensation of the Board’s Chairman since 2010,October 2016, to an annual cash retainer of $125,000, effective January 1, 2021.

Board Committee Fees

For 2020 and is2021, each of the Board committee chairs are entitled to an additional annual committee chair retainer of $20,000, $10,000 and $10,000 for the Audit Committee, Compensation Committee and Governance and Nominating Committee, respectively, payable quarterly in arrears.

2020 Director Compensation

The following table sets forth information regarding the compensation of our non-employee directors for 2020. Mr. Brickman, our Chief Executive Officer. Prior to forming JBGLOfficer, is omitted from the table as he does not receive any additional compensation for his services as a director. For more information on Mr. Brickman’s compensation, see “Executive Compensation Information” beginning on page 20.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2) | | Total ($) | |

| David Einhorn | | 50,000 | | | — | | | 50,000 | | |

Elizabeth K. Blake(3) | | 6 | | | 172,188 | | | 172,194 | |

| Harry Brandler | | 62,007 | | | 95,656 | | | 157,663 | |

| John R. Farris | | 62,007 | | | 95,656 | | | 157,663 | |

Kathleen Olsen(4) | | 82,007 | | | 95,656 | | | 177,663 | |

Richard S. Press(5) | | 72,007 | | | 95,656 | | | 167,663 | |

(1)Amount reflects the amount of annual retainer paid in 2008, Mr. Brickman was a managercash and the cash received in lieu of various joint ventures and limited partnerships that developed/built low and high-rise office buildings, multifamily and condominium homes, single family homes, entitled land and supervised a property management company. He previously also served as Chairman and Chief Executive Officer of Princeton Homes Ltd. and Princeton Realty Corporation that developed land, constructed single family custom homes and managed apartments it built. Mr. Brickman has over 38 years’ experience in nearly all phases of real estate construction, development and real estate finance property management. He received a B.B.A. and M.B.A. from Southern Methodist University.

The Board has nominated Mr. Brickman because of his substantial experience in residential land development,partial shares for the homebuilding industry and management, as well as intimate knowledgeequity portion of the Company’s businessannual retainer. As discussed above, directors may elect to receive shares of restricted Common Stock in lieu of the cash portion of the annual retainer.

(2)On June 23, 2020, each of our non-employee directors, other than Mr. Einhorn, was awarded shares of restricted Common Stock to pursuant to the 2014 Equity Plan. The restricted stock awards become fully vested on the earlier of (i) the first anniversary of the grant date, or (ii) the date of our 2021 Annual Meeting. If the director’s service terminates prior to the vesting date due to death, the shares of restricted Common Stock will become fully vested on the date of the director’s death. The grant date fair value of the restricted stock awards is included in the table in accordance with FASB ASC Topic 718. For additional information on the valuation assumptions regarding the restricted stock unit awards and operations.

the option awards, refer to Note 9 to our financial statements for the year ended December 31, 2020, which are included in our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC. As of December 31, 2020, these were the only outstanding equity awards held by our non-employee directors.

Elizabeth K. Blake (3)— Ms. Blake age 66, has been oneelected to receive the cash portion of our directors since September 2007. Before retiring, Ms. Blake servedher annual retainer in shares. Fees paid in cash reflect the value of fractional shares. Includes $10,000 for her service as Senior Vice President — Advocacy, Government Affairs & General Counsel of Habitat For Humanity International Inc. from 2006 to 2014. Ms. Blake served on the Board of Patina Oil & Gas Corporation from 1998 through its sale to Noble Energy in 2005. From March 2003 to 2005, Ms. Blake was the Executive Vice President — Corporate Affairs, General Counsel and Corporate Secretary for US Airways Group, Inc. From April 2002 through December 2002, Ms. Blake served as Senior Vice President and General Counsel of Trizec Properties, Inc., a public real estate investment trust. Ms. Blake served as Vice President and General Counsel of General Electric Power Systems from 1998 to 2002. From 1996 to 1998, Ms. Blake served as Vice President and Chief of Staff of Cinergy Corp. Ms. Blake received a Bachelor of Arts degree with honors from Smith College and her Juris Doctor from Columbia Law School, where she was a Harlan Fiske Stone Scholar. Ms. Blake was awarded an Honorary Doctorate of Technical Letters by Cincinnati Technical College and an Honorary Doctorate of Letters from the College of Mt. St. Joseph. From 1982 to 1984, she was an associate with Frost & Jacobs, a law firm in Cincinnati, Ohio and a partner from 1984 to 1996. From 1977 to 1982, she was with the law firm of Davis Polk & Wardwell in New York. She is past Chair of the Ohio Board of Regents.Governance and Nominating Committee.

The Board has nominated Ms. Blake because she provides the Board with extensive executive, managerial and leadership and corporate governance and risk management experience, her experience(4)Includes $20,000 for service as a director of public, private and non-profit corporations and her knowledgeChair of the homebuilding industry.

Audit Committee.

Harry Brandler(5) — Mr. Brandler, age 46, has been oneIncludes $10,000 for service as Chair of our directors since October 2014. Since December 2001, Mr. Brandler has served as the Chief Financial Officer of Greenlight Capital, Inc. Prior to joining Greenlight Capital, Inc., from 2000 to 2001, Mr. Brandler served as Chief Financial Officer of Wheatley Partners, a venture capital firm, where he oversaw the firm’s back office operations and restructured the firm’s marketing, client relations and technology. From 1996 to 2000, Mr. Brandler served as a Manager at Goldstein, Golub & Kessler, where he provided audit, tax and consulting services to investment partnerships and other financial organizations and where he was promoted to Manager in January 1999. Mr. Brandler received a B.S. in Accounting from New York University in 1993. Mr. Brandler was admitted as a Certified Public Accountant in New York in 1996.

Compensation Committee.

The Board has nominated Mr. Brandler because of his substantial knowledge and experience in the areas of finance, accounting and management.

John R. Farris — Mr. Farris, age 45, has been one of our directors since October 2014. Since 2007, Mr. Farris has been the founder and President of Commonwealth Economics, LLC. Prior to forming Commonwealth Economics, LLC, from 2006 to 2007, Mr. Farris served as Secretary of the Finance and Administration Cabinet for the Commonwealth of Kentucky. From 2008 to 2012, Mr. Farris served as an adjunct Professor of Economics and Finance at Centre College in Danville, Kentucky. Mr. Farris previously worked at the Center for Economics Research at the Research Triangle Institute, the World Bank and the International Finance Corporation. He currently sits on the board of directors for Kentucky Employers Mutual Insurance and the Kentucky Retirement System and previously served on the board of directors for Farmers Capital Bank Corporation (NASDAQ: FFKT). Mr. Farris received a B.S. from Centre College in 1995 and a M.P.A. from Princeton University in 1999.

The Board has nominated Mr. Farris because he brings to the Board a wealth of knowledge and experience in economics and finance and his experience with other boards.

Kathleen Olsen — Ms. Olsen, age 46, has been one of our directors since October 2014. Since 2011, Ms. Olsen has been a private investor. From 1999 through 2011, Ms. Olsen served as Chief Financial Officer of Eminence Capital, LLC, a long/short global equity fund. From 1993 to 1999, Ms. Olsen served as audit manager, specializing in investment partnerships, at Anchin, Block & Anchin LLP, a public accounting firm located in New York City. Ms. Olsen received a Bachelor of Science degree with honors from the State University of New York at Albany. Ms. Olsen is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and New York State Society of Certified Public Accountants.

The Board has nominated Ms. Olsen because she has extensive knowledge of accounting and a background in finance which enables her to make valuable and important contributions to the Board.

Richard S. Press — Mr. Press, age 79, has been one of our directors since October 2014. Before retiring, Mr. Press was a Senior Vice President at Wellington Management from 1994 to 2006, where he started and built the firm’s insurance asset management practice. Prior to that, Mr. Press was a Senior Vice President of Stein Roe & Farnham from 1982 to 1994 and Scudder Stevens and Clark from 1964 to 1982. Mr. Press has been a board member of Millwall Holdings PLC and Millwall Football Club, London since 2010; and has served as a member of the Board of Overseers of Beth Israel Deaconess Medical Center (Boston) since 2007. Previously he served on various committees of the Controlled Risk Insurance Company and the Risk Management Foundation from 2006 to 2017; served as a board member of the Housing Authority Insurance Group from 2008 to December 2014; and served as a board member and chairman of each of Transatlantic Holdings (NYSE: TRH) from August 2006 to March 2012 and Pomeroy IT Solutions (NASDAQ: PMRY) from July 2007 to November 2009. He was a founding member of the Board of Governors and the Advisory Board of the National Pediatric Multiple Sclerosis Center, Stony Brook University and Medical School, New York (2001 – 2013). Mr. Press currently serves as chairman of the Anesthesia Associates of Massachusetts and has been a member of its board since December 2015 and in 2017 was elected a board member of GMPCI Insurance, Ltd., a wholly-owned subsidiary of AAM. Mr Press earned a B.A. in Economics from Brown University in 1960; and after serving in the US Army, he received his M.B.A. from Harvard Business School in 1964.

The Board has nominated Mr. Press because of his extensive background in finance and his public company board and committee experience.

Board Voting RecommendationThe Board unanimously recommends to the stockholders that they vote “FOR” the election of each director nominee.

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR 20182021

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The Audit Committee of our Board has selectedappointed RSM US LLPto continue to serve as theour independent registered public accounting firm to audit Green Brick’s books and accounts for the fiscal year ending December 31, 2018, subject to ratification by the stockholders. In August 2016, our Audit Committee appointed 2021.

RSM US LLP to serve as the independent registered public accounting firm of the Company and dismissed Grant Thornton LLP (“Grant Thornton”), our previous independent registered public accounting firm for the year ended, December 31, 2015. RSM US LLP is considered by the Audit Committee and the management of the Company to be well qualified. Representatives of RSM US LLP are expected to be present at the meeting with the opportunity to make a statement and to respond to appropriate questions. Stockholder ratification of the appointment of RSM US LLPhas served as our independent registered public accounting firm since August 2016. The Audit Committee considers RSM to be well qualified and believes that the continued retention of RSM is in the best interests of us and our stockholders. We are asking our stockholders to ratify the selection of RSM as our independent registered public accounting firm for 2021. Although stockholder ratification of the selection of RSM is not required by our Bylaws or otherwise. However,otherwise, the Board is submitting the appointment of RSM US LLP to theour stockholders for ratification as a matter of good corporate practice. If this appointment isIn the event our stockholders do not ratified by our stockholders,ratify the selection of RSM, the Audit Committee will reconsider its selection. Even if the appointment is ratified, the Audit Committee, which is solely responsible for appointing and terminating our independent registered public accounting firm, may in its discretion reconsider the selection of RSM. Ratification of the selection of RSM will not limit the Audit Committee’s authority to terminate the engagement of RSM or direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of Green Brickus and itsour stockholders.

We expect a representative of RSM to be present at the Annual Meeting with the opportunity to make a statement if he or she desires and will also be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees

Fees for professional services provided by RSM US LLP for the fiscal years ended 20172020 and 2016,2019, including related expenses, are as follows:

| | | | 2017 | | | 2016 | | | 2020 | | 2019 |

| Audit fees (1) | | $ | 700,671 | | | $ | 879,958 | | Audit fees (1) | | $ | 653,886 | | | $ | 759,839 | |

| Audit-related fees | | $ | — | | | $ | — | | |

Audit-related fees (2) | | Audit-related fees (2) | | 65,000 | | | — |

| Tax fees | | $ | — | | | $ | — | | Tax fees | | — | | — |

| All other fees | | $ | — | | | $ | — | | All other fees | | — | | — |

| Total fees | | $ | 700,671 | | | $ | 879,958 | | Total fees | | $ | 718,886 | | | $ | 759,839 | |

|

(1) | (1)Audit fees for 2020 and 2019 include fees for 2017 include professional services rendered by RSM US LLP for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, review of the Company’s condensed consolidated financial statements included in the Company’s Quarterly Reports on Form 10-Q, and audit of the Company’s internal control over financial reporting. Audit fees for 2016 include professional services rendered by RSM US LLP for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, review of the Company’s condensed consolidated financial statements included in the Company’s third quarter Quarterly Report on Form 10-Q, and audit of the Company’s internal control over financial reporting. |

Fees for professional services providedrendered by our former independent registered public accounting firm, Grant Thornton,RSM for the fiscal years ended 2017audit of our consolidated financial statements included in our Annual Report on Form 10-K, review of our condensed consolidated financial statements included in our Quarterly Reports on Form 10-Q, and 2016, includingaudit of our internal control over financial reporting.

(2)Audit-related fees for 2020 include fees related expenses, are as follows:to consents and a comfort letter related to our secondary offering.

| | | 2017 | | | 2016 | |

| Audit fees (1) | | $ | 79,500 | | | $ | 410,040 | |

| Audit-related fees | | $ | — | | | $ | — | |

| Tax fees | | $ | — | | | $ | — | |

| All other fees | | $ | — | | | $ | — | |

| Total fees | | $ | 79,500 | | | $ | 410,040 | |

(1) | Audit fees for 2017 include professional services rendered by Grant Thornton LLP related to a consent and successor auditor services for the Company’s consolidated financial statements for the year ended December 31, 2015. Audit fees for 2016 include professional services rendered by Grant Thornton for the audit of the Company’s consolidated financial statements included in the Company’s 2015 Annual Report on Form 10-K, review of the Company’s condensed consolidated financial statements included in the Company’s first and second quarters Quarterly Reports on Form 10-Q, and successor auditor services, such as, the reissuance of opinion in the Company’s 2016 Annual Report on Form 10-K. |

Audit Committee Approval of Audit and Non-Audit Services

The Audit Committee pre-approves all audit, audit-related and permitted non-audit services provided by the independent registered public accounting firm, including the fees and terms for those services. The Audit Committee has adopted a policy and procedures governing the pre-approval process for audit, audit-related and permitted non-audit services. The Audit Committee pre-approves audit and audit-related services in accordance with its review and approval of the engagement letter and annual service plan with the independent registered public accounting firm. TaxAny tax consultation and complianceor other consulting services proposed to be provided by RSM are considered for approval by the Audit Committee on a project-by-project basis. Non-audit and other services provided by the independent registered public accounting

firm will be considered by the Audit Committee for pre-approval based on business purpose, reasonableness of estimated fees and the potential impact on the firm’s independence.

11

Board Voting Recommendation

Change in Independent AuditorAs previously reported, on August 26, 2016, the Audit Committee, in consultation with the Company’s Board of Directors, approved the engagementappointment of RSM US LLP as the Company’s newour independent registered public accounting firm effective immediately, and dismissed Grant Thornton as its independent registered public accounting firm.

The reports of Grant Thornton on the Company’s consolidated financial statements for the fiscal years ended December 31, 2015 and 2014 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2015 and 2014 and the subsequent interim period through August 26, 2016, there had been no “disagreements” (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions) with Grant Thornton on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Grant Thornton, would have caused Grant Thornton to make reference thereto in their reports on the consolidated financial statements for such fiscal years. During the fiscal years ended December 31, 2015 and 2014 and any subsequent interim period through August 26, 2016, there had been no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K), except that the Company’s internal control over financial reporting was not effective due to the existence of material weaknesses in the Company’s internal control over financial reporting. As disclosed in the Company’s Annual Report on Form 10-K for the fiscal year endedending December 31, 2015, and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June 30, 2016, the following material weaknesses were identified:

2021.